First, after talking to many people and reading books on allowance, we decided NOT to have allowance tied to chores. Our kids are expected to help around the house because they live here, not because they get paid to do them. Also, it only takes one time of them deciding they don't want allowance, and the chore thing goes out the window, and a fight ensues.

We also decided that for them to learn how to manage money, they had to have it in hand. Just like if you want them to read they need a book in hand. So we give them $1 per month for every year old they are. So DD1 now gets $8/mo., DD2 $6/mo., DD3 nothing (allowance doesn't start until Kindergarten. It also ends at age 12 when they are old enough to get babysitting jobs.) If they want to earn more money, there are extra chores they can do as well.

When do we do this? In a perfect world we would get to it the beginning of every month. However that doesn't always happen. In fact sometimes we miss a month entirely. HOWEVER, there are consequences for us as parents if we go past the 15th of the month. We PAY a late fee of $1. Our girls LOVE this. In fact they won't hound for allowance because they hope that we are late. We use this to teach them that it costs you more money if you are late paying your bills.

I also want to add in here that we do some things in extremes in this system - like paying a $1 late fee. That is a big percentage. We also match their savings by 100% - another big percentage. I think this helps them understand the concepts better and gets them excited about the rules of investing.

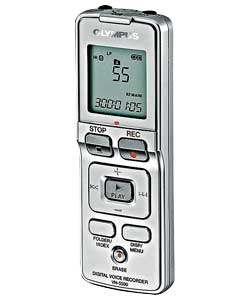

So HOW do we do this? They each have a little bank that we got from this link http://deseretbook.com/store/product/5007477. We start out by giving them in $1 bills their entire allowance. Then they give us back a dollar, we give them change so that they can pay tithing - 10% of their gross income. They put that into their slot. I am going to start to have them fill out their tithing slip right there so that it is sure to make it to church.

Next is savings. Same thing as for Tithing. They are required to save 10% and then we match it 100% as above. We show them as they put their money in their bank, that then we are putting in the same amount of money. Again the extreme, but we want them to learn that when you invest money, you make money. (I am thinking about upping this percentage to 20%. They both have quite a bit of money now, and I think they can manage this.)

Last is their fun money. This is what they get to spend. They love this and so do I. If they want a toy, great, if they can afford it, they can have it! No more fights in Target no more whining for other things either. It is also funny, they DON'T want to buy stuff at Target. They want to go to the thrift store or yard saling because they understand they get more for their money that way.

What about borrowing? Sometimes, they don't have their money when they want something. Fine, they can borrow some money. However, if they don't pay me back RIGHT when we get home, they owe ME a late fee (just like a credit card). Their interest is $0.25. This is the same if they borrow money from each other.

Sometimes I borrow money/cash from them because I rarely carry cash. I then owe them the $0.25 borrowing fee. I LOVE that the rules go both ways. That means no whining about when things don't go your way. The rules apply to everyone.

If they borrow money because they are completely out of money, they would be charged a 100% fee for that. So if they want $5 for a movie, by the next Sat. they would be required to pay me $10. We haven't hit that yet, but I am sure we will someday. Again, an extreme, to make it hurt to borrow, and spend, money when you don't have it in the first place.

We do have some money charges tied into chores if they don't do them and I have to do them. They pay me a cleaning fee. But I will blog about that in my chore section.

I got most of these ideas from a book called The Parenting Breakthrough by Merrilee Boyack. It is written for an LDS audience, however no matter what faith you are, the ideas are easily transferrable. This woman is AMAZING at what her kids know by the time they are 18. Here is the link http://deseretbook.com/store/search?query=the+parenting+breakthrough. Both the tin and the book are from the same website so you can save on shipping. This book is in my permanent library of parenting books. I would pay twice the full price for this book. That is how much I LOVE it.

One other thing. How do the girls like this? They LOVE it. It is so fun to hear them say, "They want $10 for that? That is waaay to much. or I will just get one at the Thrift store." They understand that it costs a lot of money to eat out and if you run out of money you have to wait until the next pay period.

They are sooo money savvy it makes me laugh. The next step is teaching them about investments, but I need to learn more about them myself before we head into that territory :)